What Our Clients Need to Know About Government Shutdowns

At Higgins & Schmidt, we often remind clients that the headlines can feel louder than their actual impact on your long-term plan. Few topics stir as much noise in Washington as the threat of a government shutdown. With the end of the fiscal year always looming on September 30, the question comes up frequently: What does this mean for me and my portfolio?

Recently, Invesco’s Global Market Strategist Brian Levitt published timely research on this very issue. We’re pleased to share these insights in collaboration with Invesco.

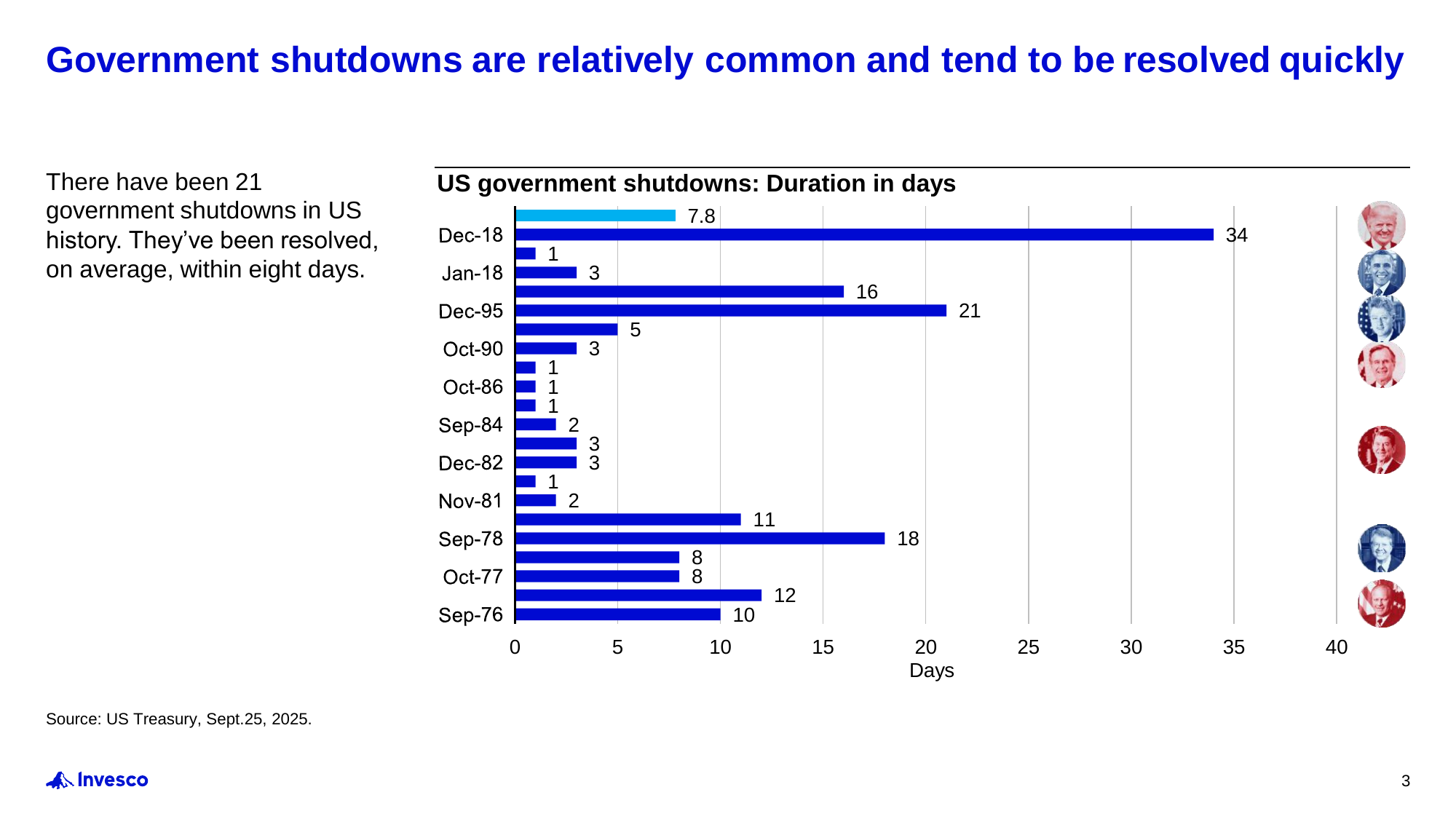

Shutdowns Are Frequent—But Usually Short

Since the 1970s, there have been 21 government shutdowns in U.S. history. They’ve typically been resolved quickly, lasting an average of just eight days. While they can be disruptive for federal workers and non-essential services, shutdowns rarely drag on long enough to meaningfully shift economic fundamentals.

What Keeps Running—and What Stops

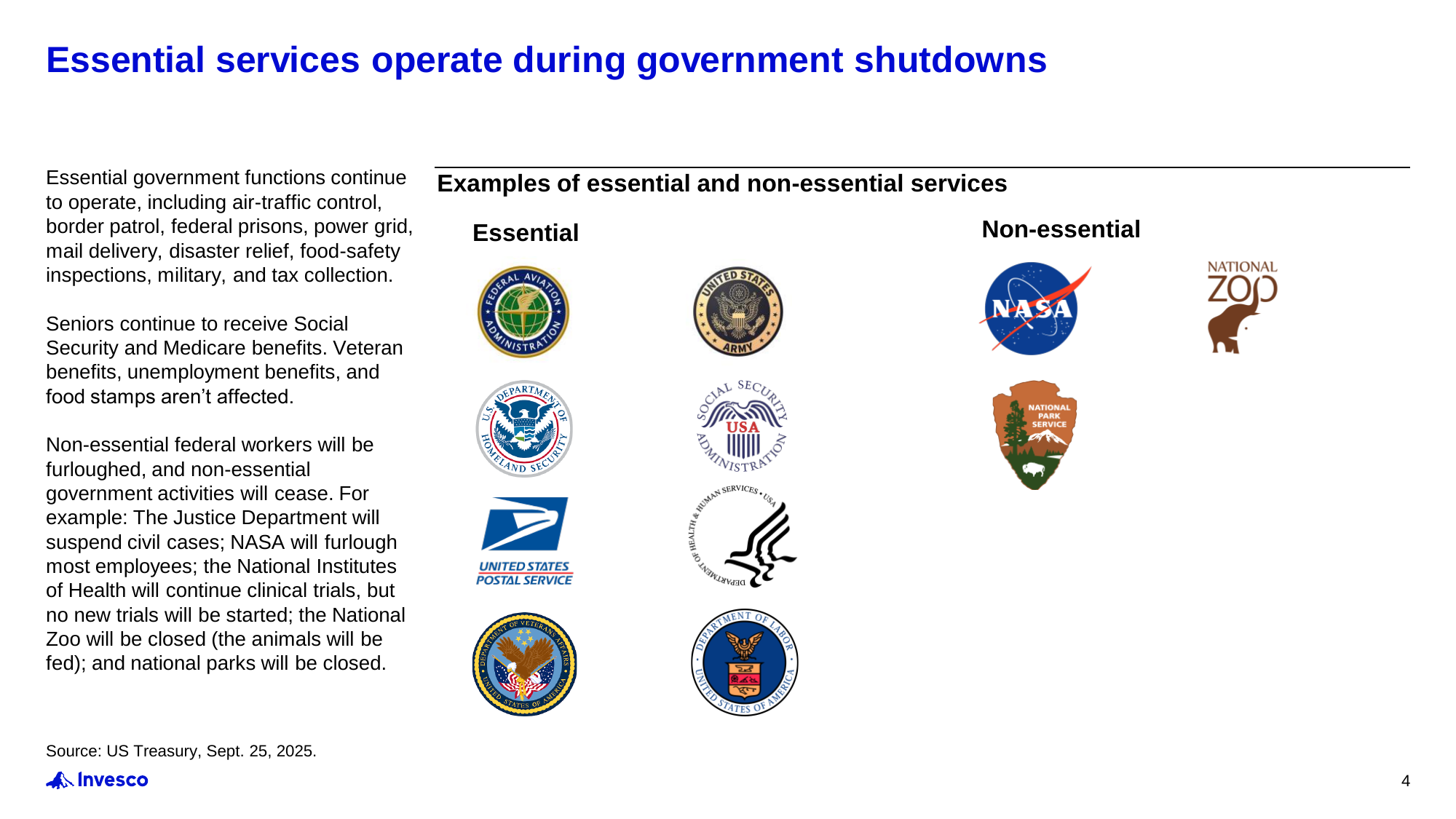

Not everything halts during a shutdown. Essential services continue: air traffic control, border patrol, prisons, the power grid, mail delivery, disaster relief, food safety inspections, and Social Security and Medicare benefits all remain in place. Veterans’ benefits, unemployment checks, and food assistance programs are unaffected.

What does pause are non-essential activities: civil cases at the Department of Justice, many NASA programs, the start of new NIH clinical trials, national parks, and even the National Zoo. In other words, some visible disruptions occur, but the backbone of the economy keeps moving.

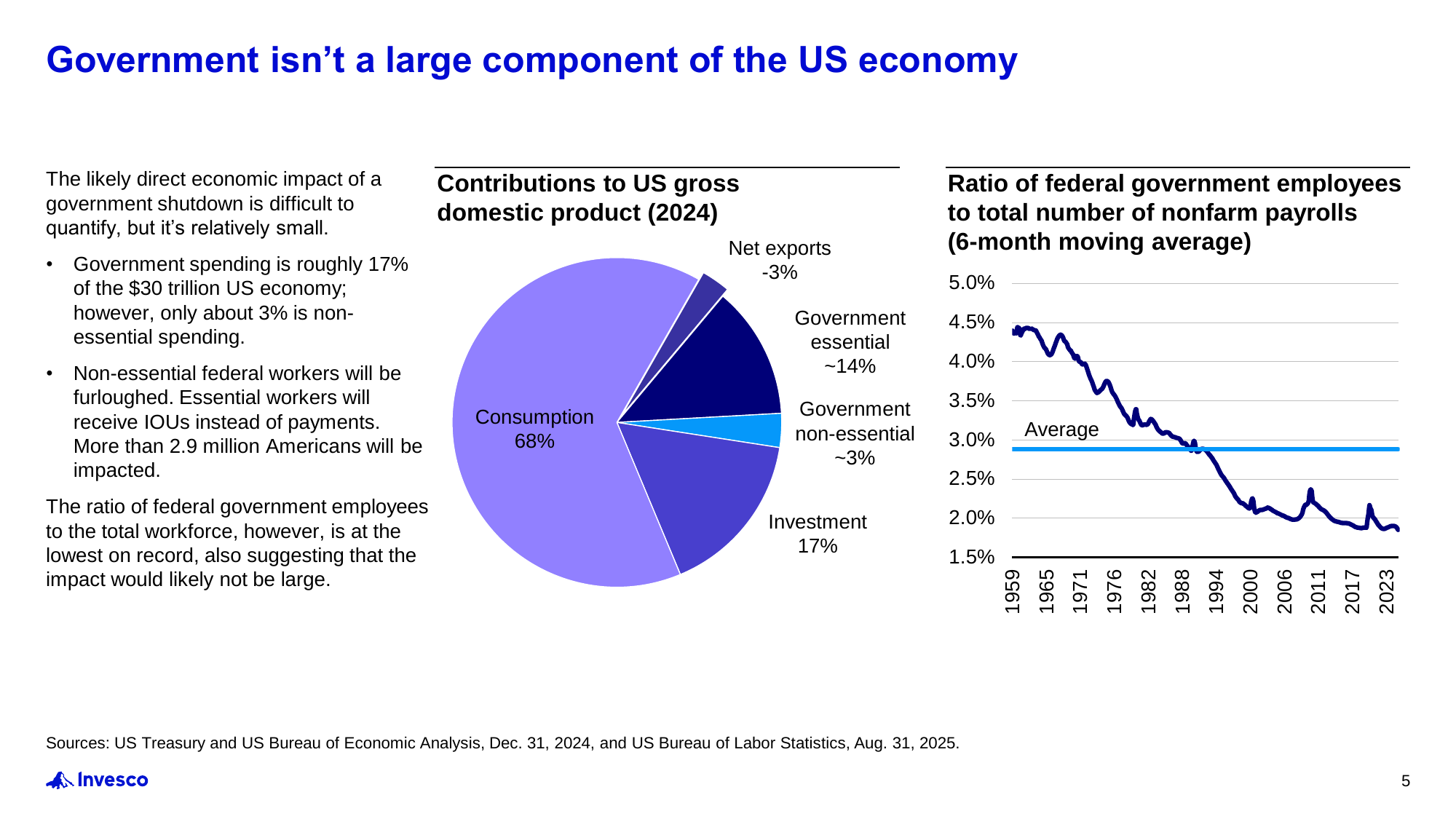

The Economy’s Exposure Is Limited

The federal government makes up about 17% of the U.S. economy, but only around 3% of spending is considered non-essential. That portion is what pauses during a shutdown.

Federal employees represent the lowest share of the U.S. workforce on record. While nearly 3 million Americans are impacted through furloughs or delayed paychecks, the scale relative to a $30 trillion economy suggests that the direct economic hit is relatively small.

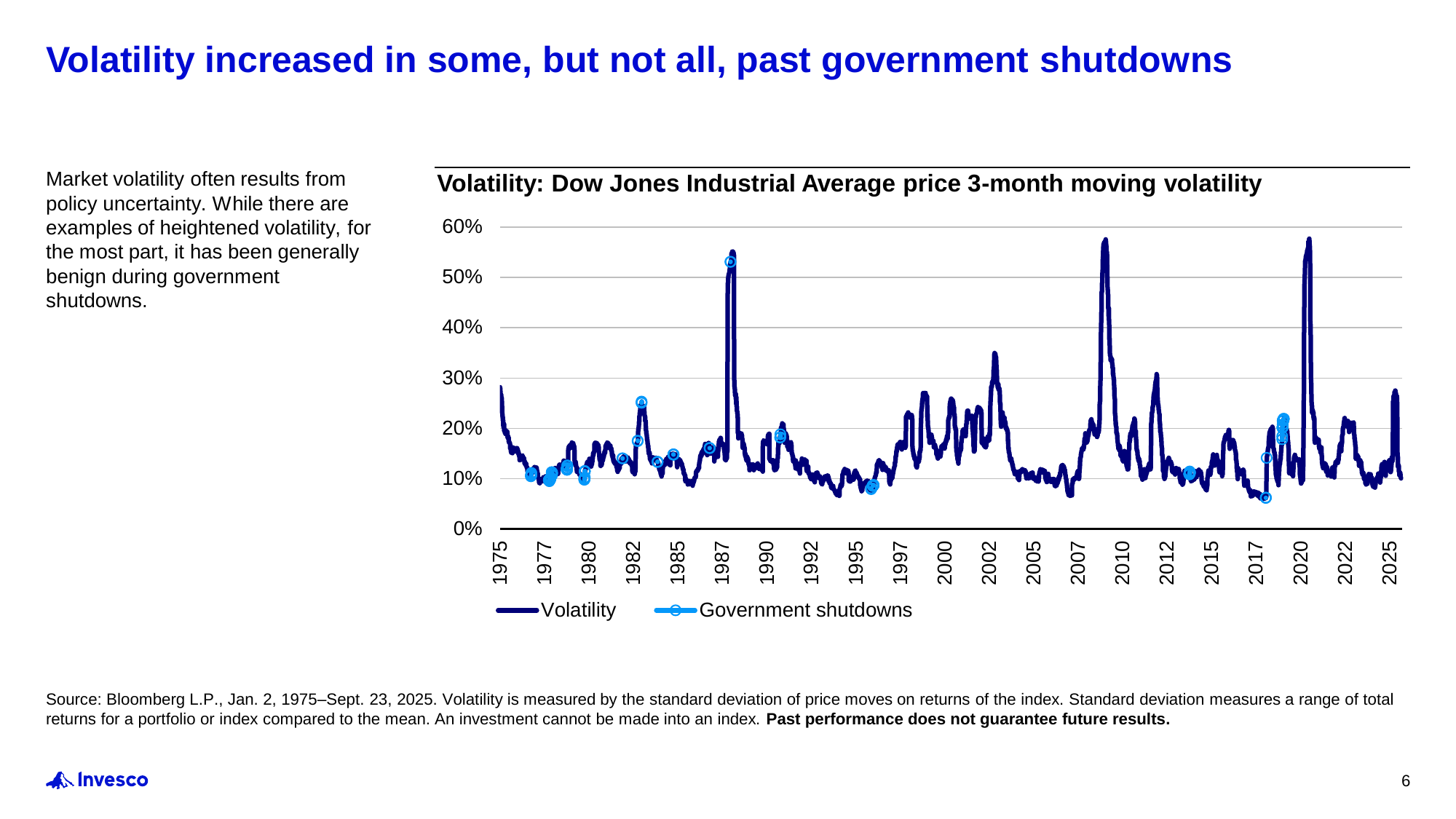

How Markets React

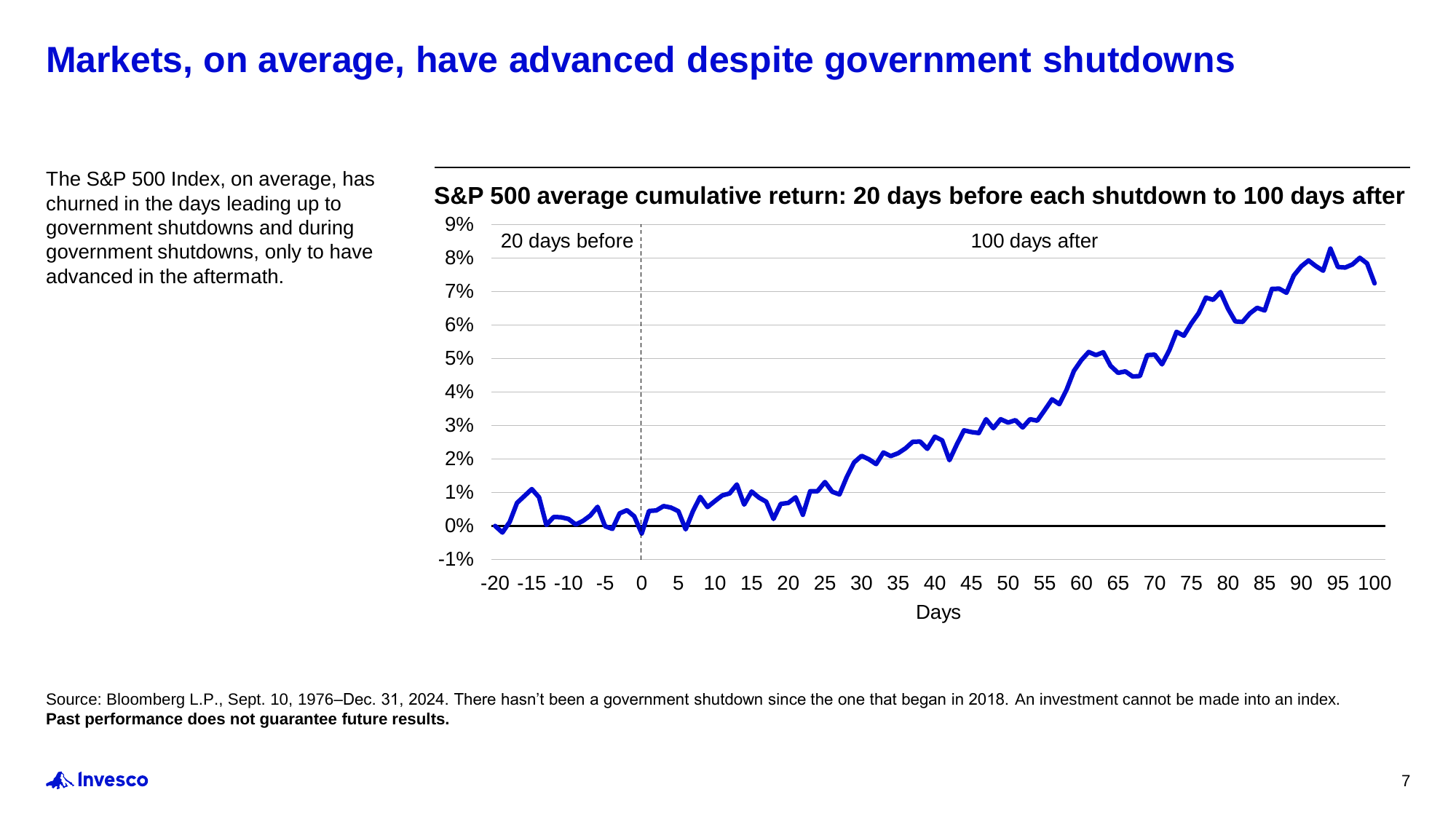

Policy uncertainty often introduces volatility, but history shows it has generally been benign during shutdowns. The Dow Jones and S&P 500 have experienced short-term churn in the lead-up and during shutdowns, but the long-term picture is far more reassuring.

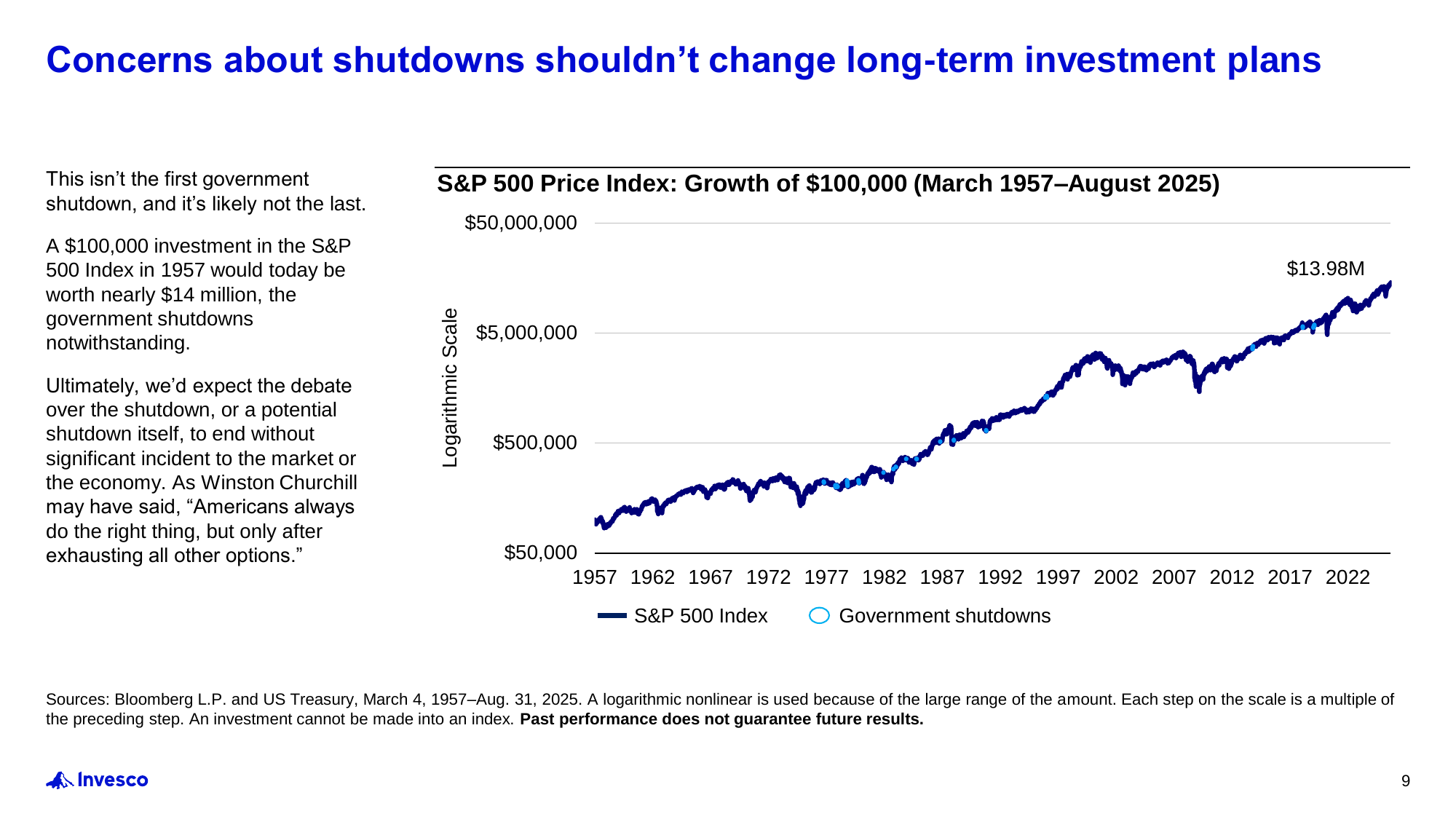

• Over half of past shutdowns saw positive equity returns.

• The average return during a shutdown is essentially flat at +0.1%.

• The S&P 500 has tended to advance once the shutdowns end.

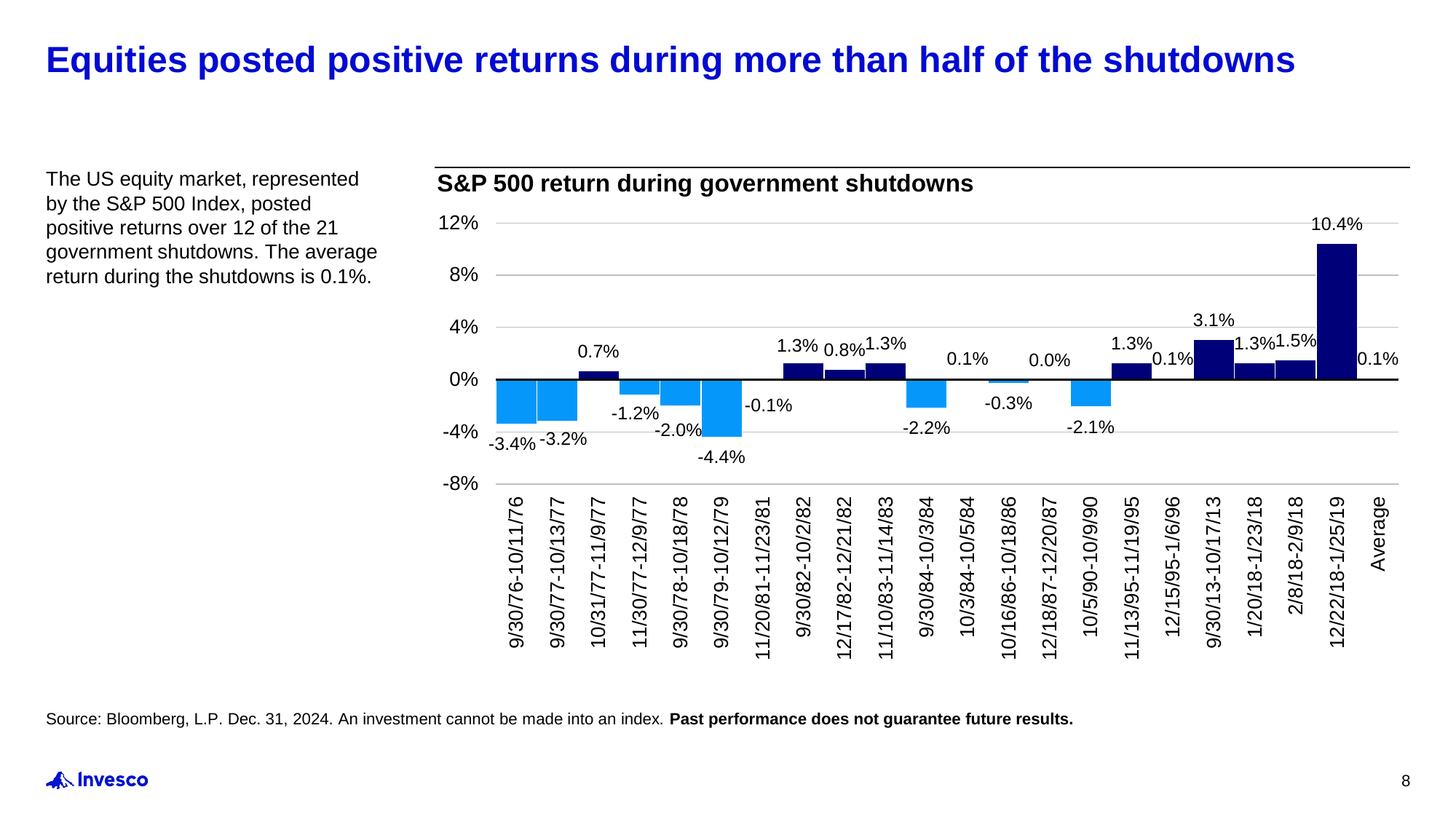

A striking example: a $100,000 investment in the S&P 500 in 1957 would be worth nearly $14 million today, despite two dozen shutdowns along the way.

The Real Takeaway

Markets have a way of pushing through political noise. Shutdowns may generate headlines, spark uncertainty, and rattle investors in the short run. But as Brian Levitt emphasizes, they’ve had minimal long-term impact on market outcomes.

Our advice remains consistent:

• Stay the course with your long-term investment plan.

• Don’t let short-term political headlines drive your financial decisions.

• Use periods of volatility as reminders of why diversification and discipline matter.

Or as Winston Churchill put it, Americans eventually “do the right thing, but only after exhausting all other options.”

In Collaboration with Invesco

This perspective is based on research from Brian Levitt, Global Market Strategist at Invesco. We are grateful to partner with Invesco in sharing these insights with you.

Shutdowns will likely come and go. What matters most is keeping your plan and process aligned with your goals, and that’s where we continue to focus our work.

As always, if you have any questions or concerns, we encourage you to reach out.

All data provided by Invesco unless otherwise noted.

These opinions may differ from those of other Invesco investment professionals. These comments should not be construed as recommendations but as an illustration of broader themes. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions; there can be no assurance that actual results will not differ materially from expectations

Securities offered through LPL Financial, Member FINRA/SIPC. Investment advice offered through Higgins & Schmidt Wealth Strategies, a registered investment advisor and separate entity from LPL Financial. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification and asset allocation does not ensure a profit or protect against a loss. Stock investing involves risk including loss of principal. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price. Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs and does not assure a profit or protect against a loss.