“One Big Beautiful Bill” Highlights

July 8, 2025

After months of negotiations, a new tax and spending bill was approved by Congress and signed into law by President Trump on July 4. This new budget is far-reaching, including making many parts of the Tax Cuts and Jobs Act permanent, raising state and local tax exemptions (“SALT”), extending the estate tax limits, and much more. It attempts to offset some of these provisions with spending cuts in key areas such as Medicaid.

This bill matters because, while trade policy has been at the forefront over the past several months, tax and spending policy in Washington has been a growing source of uncertainty for many years. While there is political disagreement with the direction of this new budget, it does take the possibility of a “tax cliff” off the table - a situation where tax policy could have changed dramatically if provisions expired at the end of this year.

Here are a couple highlights of the bill:

Current TCJA tax rates and brackets are now permanent. They were originally set to expire at the end of 2025.

The standard deduction increases to $15,750 for single filers and $31,500 for joint filers in 2025.

There is an additional $6,000 deduction for qualifying seniors (sometimes referred to as a “senior bonus”) that phases out for gross incomes exceeding $75,000. The provision expires in 2028.

The alternative minimum tax exemption is now permanent. It also increases phaseout thresholds to $500,000 for single filers, which will be indexed for inflation in the future.

The child tax credit rises from $2,000 to $2,200 per child, with future adjustments indexed to inflation to maintain purchasing power over time.

The state and local tax (SALT) deduction cap increases to $40,000 from a $10,000 limit with annual increases of 1% through 2029. It is then scheduled to revert back to $10,000 in 2030. For Colorado taxpayers, given the state’s 4.4% income tax rate, this increased cap could mean significant tax savings for those with taxable income over approximately $227,000.

A deduction for tip income capped at $25,000 annually for workers earning less than $150,000, effective through 2028.

Some green energy tax credits are repealed, including for electric vehicles and residential energy efficiency credits. Electric vehicle tax credits expire September 30th and home energy tax credits, such as solar panels, expire December 31st.

The federal debt limit increases by $5 trillion. This will prevent Congress from having to debate and approve debt limit increases for some time, reducing political uncertainty.

For businesses, the bill expands tax breaks designed to encourage domestic investment and job creation.

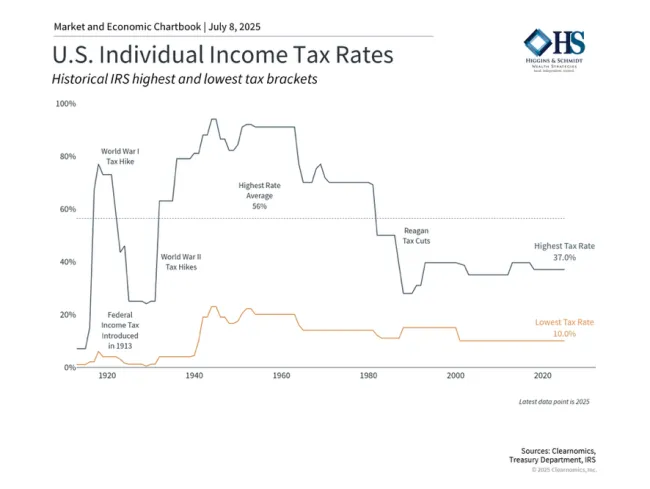

These and many other changes maintain the relatively low tax environment that has characterized the past several decades. As the chart above shows, current tax rates remain well below the peaks experienced during much of the 20th century, when top marginal rates exceeded 70% and sometimes reached above 90% during wartime periods.

Growing concerns over fiscal deficits

The Congressional Budget Office, a non-partisan agency that supports Congress, estimates that this new tax and spending bill will add $3.4 trillion to the national debt over the next decade. This is against the backdrop of a federal debt that already exceeds $36.2 trillion.

Unfortunately, there are no easy solutions to this challenge, especially because this is a contentious political topic. On the one hand, tax cuts can stimulate economic growth, which may help to offset revenue losses through increased economic activity. On the other hand, Washington has a poor track record of balancing budgets even when the economy is strong. The last balanced budgets occurred 25 years ago during the Clinton years, and 56 years before that during the Johnson administration.

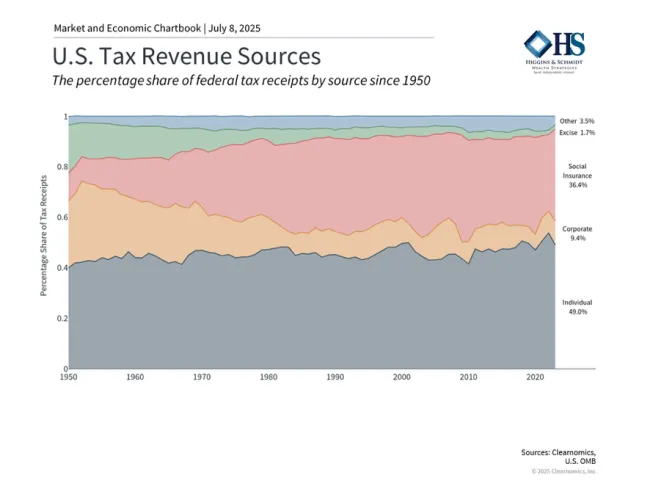

It's also important to remember that the U.S. tax system has evolved significantly starting from modest rates in 1913, peaking during WWII with top rates reaching 94% by 1944, to the more recent President Reagan’s Tax Reform Act in the 1980s. As the above chart shows, today, individual income taxes are the main source of federal revenue, along with payroll taxes funding Social Security and Medicare. Corporate taxes (which were reduced by the TCJA), tariffs, and others make up smaller shares.

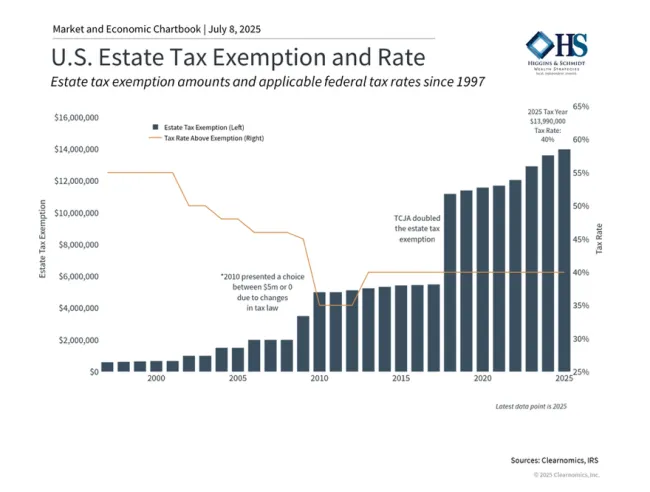

The bill continues the higher estate tax exemption limit

One set of provisions that would have been at the center of a tax cliff is the estate tax exemption. The TCJA doubled these limits which were scheduled to revert to previous levels this year. However, the passage of the new tax bill makes these higher exemptions permanent, further increasing the threshold to $15 million for individuals and $30 million for couples in 2026.

While it may seem like estate taxes only apply to higher net worth households, the reality is that all families must consider how assets can be passed to future generations. This requires a holistic approach that integrates estate planning, tax efficiency, philanthropy, and long-term family wealth preservation goals.

At Higgins & Schmidt Wealth Strategies here in Colorado we’re pleased from a tax perspective to see the SALT (State and Local Tax) deduction limit increase from $10,000 to $40,000 for the next five years. If you’ve been thinking about adding solar panels or an electric vehicle, 2025 is a great year to make that move. I know I’ll be exploring solar options to take advantage of all this Colorado sunshine.

From a financial strategy standpoint, we appreciate the increased clarity and are already beginning to tailor our plans with these new tax provisions in mind. Regarding the growing deficits and national debt, we remain committed to a disciplined approach, focusing on maintaining a long-term perspective.

Securities offered through LPL Financial, Member FINRA/SIPC. Investment advice offered through Higgins & Schmidt Wealth Strategies, a registered investment advisor and separate entity from LPL Financial. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification and asset allocation does not ensure a profit or protect against a loss. Stock investing involves risk including loss of principal. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price. Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs and does not assure a profit or protect against a loss.

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company's stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security--including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.